The 15-Second Trick For Affordable Care Act Aca In Toccoa Ga

Table of ContentsThe Ultimate Guide To Health Insurance In Toccoa GaSee This Report on Life Insurance In Toccoa GaThe 7-Minute Rule for Life Insurance In Toccoa GaWhat Does Annuities In Toccoa Ga Mean?

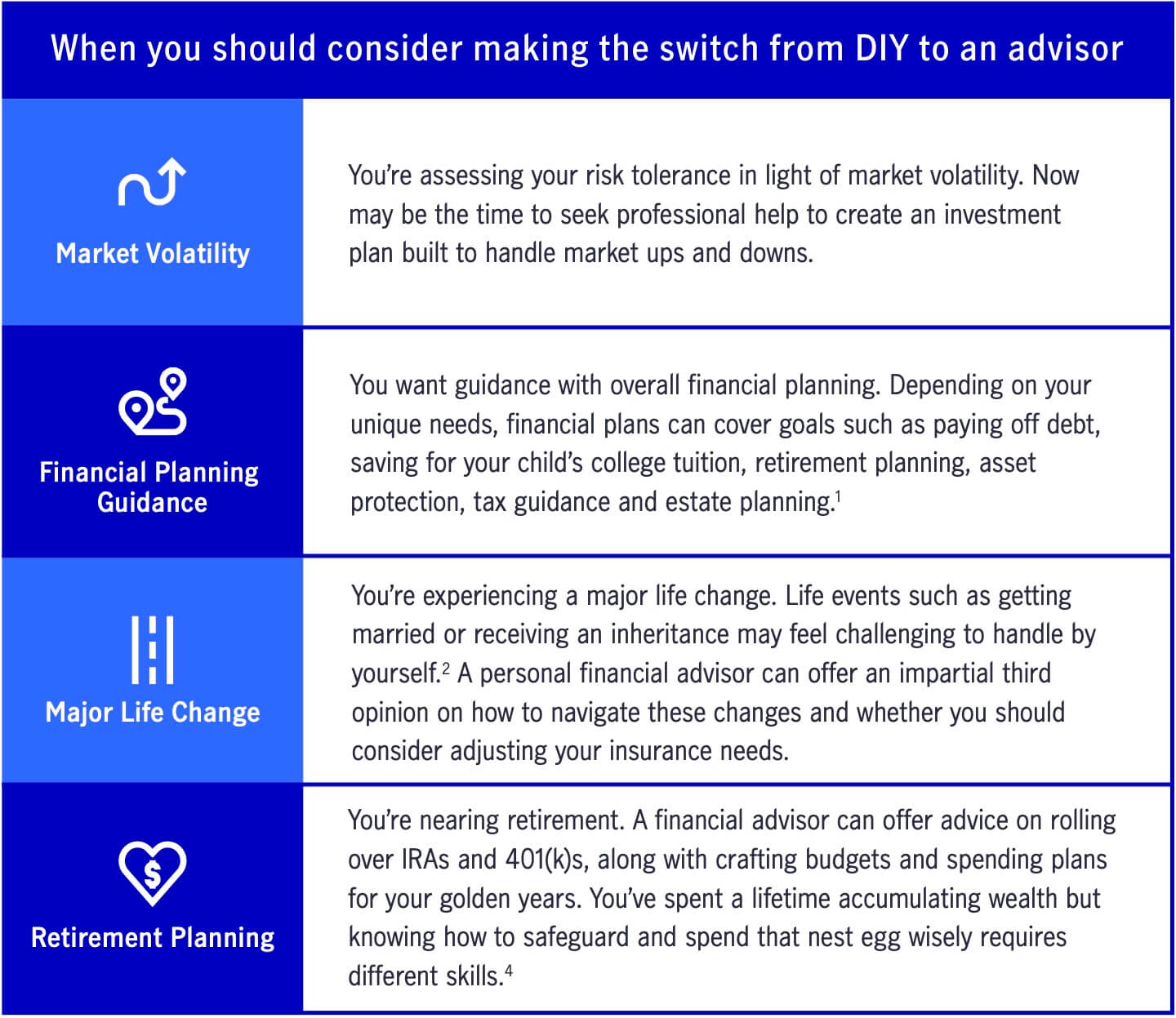

An economic advisor can additionally aid you make a decision exactly how finest to achieve goals like conserving for your youngster's university education and learning or settling your debt. Although monetary consultants are not as fluent in tax obligation legislation as an accountant may be, they can provide some assistance in the tax obligation preparation process.Some monetary consultants offer estate planning solutions to their clients. It's vital for financial advisors to remain up to day with the market, economic conditions and consultatory ideal methods.

To sell financial investment products, consultants have to pass the pertinent Financial Market Regulatory Authority-administered exams such as the SIE or Collection 6 exams to acquire their qualification. Advisors who wish to sell annuities or other insurance products need to have a state insurance permit in the state in which they plan to market them.

All About Commercial Insurance In Toccoa Ga

For instance, let's state you have $5 million in assets to take care of. You hire a consultant that charges you 0. 50% of AUM annually to benefit you. This implies that the expert will certainly receive $25,000 a year in charges for managing your financial investments. Due to the normal fee framework, several consultants will not function with customers that have under $1 million in properties to be managed.

Financiers with smaller sized portfolios could look for a monetary expert who charges a hourly charge rather of a percent of AUM. Hourly charges for advisors commonly run in between $200 and $400 an hour. The even more complex your financial situation is, the more time your consultant will have to commit to handling your properties, making it extra pricey.

Advisors are experienced specialists that can assist you create a prepare for economic success and apply it. You could additionally consider connecting to an expert if your personal monetary situations have just recently ended up being extra difficult. This can suggest acquiring a home, marrying, having kids or obtaining a large inheritance.

The Single Strategy To Use For Medicare Medicaid In Toccoa Ga

Prior to you consult with the expert for a preliminary consultation, consider what services are most important to you. Older adults may need help with retirement preparation, while more youthful grownups (Health Insurance in Toccoa, GA) might be trying to find the most effective means to invest an inheritance or starting a business. You'll want to choose an expert that has experience with the solutions you desire.

What business were you in prior to you got into monetary encouraging? Will I be functioning with you directly or with an associate consultant? You might likewise desire to look at some sample economic plans from the expert.

If all the samples you're supplied coincide or comparable, it might be an indicator that this expert does not appropriately personalize their guidance for each and every client. There are 3 main kinds of economic encouraging specialists: Licensed Economic Planner professionals, Chartered Financial Experts and Personal Financial Specialists - https://www.slideshare.net/jimthomas30577. The Licensed Financial Coordinator specialist (CFP specialist) qualification shows that an advisor has met a specialist and honest requirement established by the CFP Board

Everything about Health Insurance In Toccoa Ga

When choosing an economic advisor, think about a person with an expert credential like a CFP or CFA - https://allmyfaves.com/jstinsurance1?tab=jstinsurance1. You may additionally consider an advisor that has experience in the services that are essential to you

These advisors are usually filled with disputes of rate of interest they're much more salespeople than experts. That's why it's essential that you have an advisor that works just in your ideal passion. If you're seeking an advisor who can truly provide genuine value to you, it is necessary to investigate a number of prospective alternatives, not just pick the given name that advertises to you.

Presently, lots of advisors have to act in your "best interest," however what that requires can be nearly void, except in one of the most egregious situations. You'll need to locate a genuine fiduciary. "The initial examination for a great economic advisor is if they are benefiting you, as your supporter," states Ed Slott, CPA and creator of "That's what a fiduciary discover this info here is, however everyone states that, so you'll require other indications than the advisor's say-so and even their qualifications." Slott suggests that consumers aim to see whether advisors purchase their ongoing education around tax obligation planning for retirement savings such as 401(k) and IRA accounts.

"They ought to confirm it to you by revealing they have actually taken significant ongoing training in retirement tax and estate planning," he claims. "You should not invest with any advisor who doesn't invest in their education.